2020 was a year of tremendous growth in the cryptocurrency industry. We saw Bitcoin reach new highs, as renowned financial institutions invested in this revolutionary asset class and enthusiasm across the market bounced back.

As a global cryptocurrency exchange with offices in San Francisco, CA, and Japan, we at bitFlyer decided to dive deep into the current state of investing and cryptocurrencies in the US and Japan, and explore the differences between these two markets. Our survey targeted 3000 participants aged 20-59 across Japan and the US.

Key Findings From Our Research:

• Two-thirds of people in the US said they’re interested in investing more in financial assets in 2021.

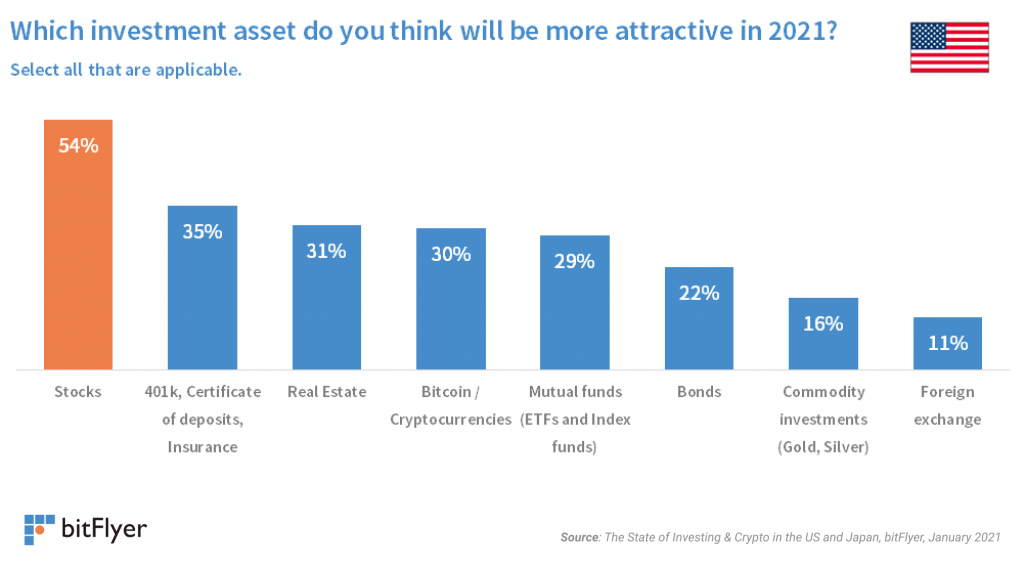

• 30% of Americans think Bitcoin/Cryptocurrencies will be an attractive investment this year, making it two times more popular than Gold and the 4th most selected asset. The most popular asset was stocks at 54%.

• 82% of the US population has heard about cryptocurrencies.

• Roughly 20% of respondents in the US are currently using or have used cryptocurrencies in the past.

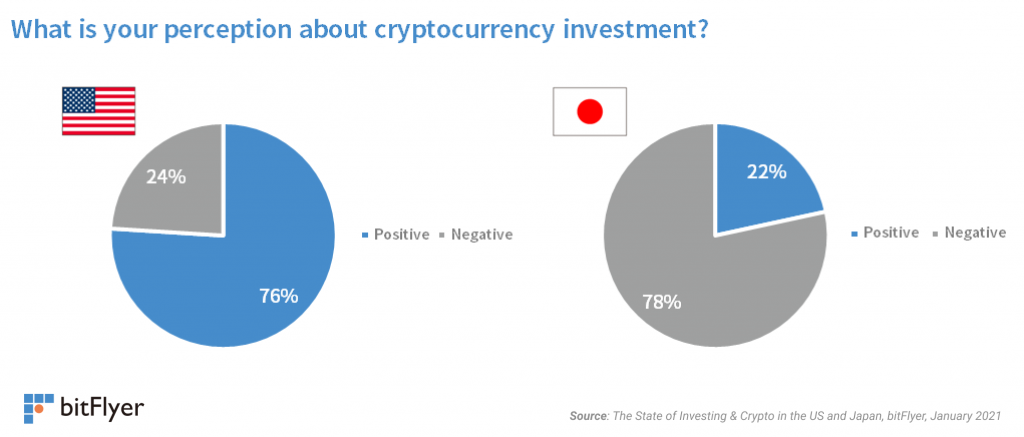

• 76% of people in the US that have heard about crypto have a positive perception about cryptocurrencies as an investment. In Japan, 78% of the respondents have a negative perception, showing a pretty strong contrast between the two regions.

• Our research shows that the current market sentiment amongst American investors is very bullish compared to the Japanese, reinforcing the argument that the last run-up in price was mainly driven by US investors.

The State of Investing

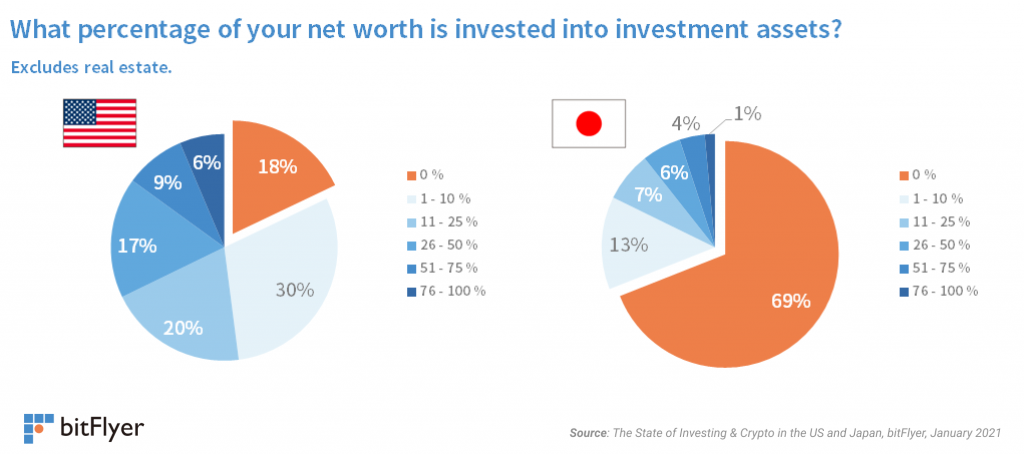

Our research shows that 82% of people in the US invest in financial assets, with almost a third of the population allocating over a quarter of their net worth into investments. On the other hand, in Japan, 69% of people do not invest in financial assets, showing a significant contrast across the two regions.

In both the US and Japan, men tend to invest more than women, while also allocating a higher share of their net worth into their investments.

There is also a significant difference in the outlook for investing this year. 68% of respondents in the US are planning to invest or continue investing, whereas that figure is only 18% in Japan.

Why are people investing in 2021?

Across the globe, one of the most popular reasons people are looking to invest this year is to prepare for the future and increase their long-term net worth. A large share of respondents are looking to diversify their income through investments and believe that investing is the most powerful and quickest way to grow their wealth.

“In order to build your wealth, you will want to invest your money. Investing allows you to put your money in vehicles that have the potential to earn strong rates of return. If you don’t invest, you are missing out on opportunities to increase your financial worth.” (Male in his 30s, US)

After last year’s events, more people are paying attention to the market in hopes of capitalizing on a potential economic rebound this year.

“This is a great time to invest, hopefully things can only get better and go up.” (Female in her 30s, US)

Low interest rates are also fueling people’s motivation to allocate their wealth into investment assets. We can see a similar trend in Japan.

“Interest is too low for deposits and savings. I think it is better to manage your capital with some risk.” (Male in his 40s, Japan).

Why are people not looking to invest in financial assets?

There’s an interesting contrast in why people are not looking to invest across the two regions.

One of the most popular reasons why people in the US are not planning to invest this year is because of financial challenges created by the COVID-19 crisis.

“I have no job currently, so no income. Can’t invest what you don’t have.” (Male in his 30s, US)

“Money is very tight due to the pandemic.” (Female in her 30s, US)

Our data shows that, logically, people with lower incomes are 40% less likely to invest. This, amidst the recent surge in COVID-19 cases and changes in power in the US, has elevated people’s uncertainty and fear of what’s going to happen next at the macroeconomic level.

What’s most interesting, however, is that the main reason why Americans do not invest isn’t because of the risks of losing money. They mainly don’t do it because they don’t have the necessary resources. In Japan, it’s a different story.

While the economic impact from the COVID-19 crisis also impacted many people’s ability to invest in Japan, the majority of those who said that they are not looking to invest highlighted the potential risks associated with investing, rather than a lack of resources to do so.

“I don’t want to lose even 0.0001% of my money. I don’t want to invest in anything that has the risk of losing even a small amount of money. However, if there is a no-risk, high-return investment, I will definitely do it.” (Male in his 40s in Japan)

“I think investment is the same as gambling. I don’t want to do dangerous things like losing money.” (Male in his 30s in Japan)

“I don’t know how to do it, and it seems that there is a high risk of loss.” (Female in her 30s, Japan)

“I do not invest because there are risks associated with investing.” (Women in their 40s, Japan)

There’s a clear difference in the sentiment towards investing between the two regions. We see people in the US being a lot more open to investing and having a bigger desire to diversify their income through investing. In Japan people tend to have a much more cautious stance.

The State of Crypto

Cryptocurrencies are becoming more popular in the US.

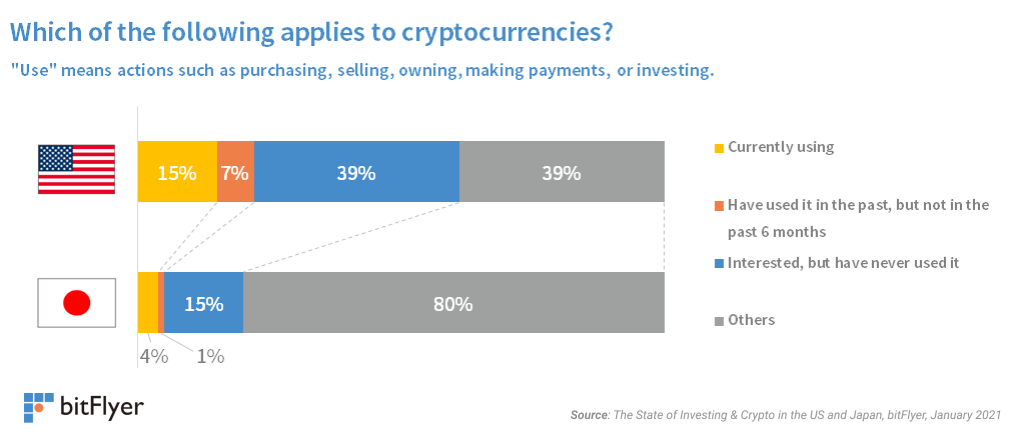

Based on our research, cryptocurrency adoption is higher in the US than it is in Japan. In the US, 22% of respondents have invested in crypto at some point – over four times higher than Japan.

Similar to investing, the sentiment towards cryptocurrencies is a lot stronger in the US than it is in Japan. 76% of the respondents in the US who have heard about cryptocurrencies have a positive perception about cryptocurrencies as an investment, while in Japan it was the complete opposite.

What is driving people’s positive perception about cryptocurrencies?

People like cryptocurrencies in the US and Japan for very similar reasons. One of the most popular ones is the increasing popularity of cryptocurrencies and its remarkable rise in price, which makes it a very attractive investment.

“Cryptos are growing at a fast rate and I feel they will keep growing and be very profitable.” (Male in his 20s, US)

“I saw in the news that the value has increased recently.” (Male in his 20s in Japan)

But it’s not only Bitcoin’s run-up in price that’s getting people’s attention. Many respondents highlighted crypto’s value propositions and believe in its long-term value.

“I feel [cryptocurrencies] put you in control as opposed to big Wall street firms. You can buy/sell 24/7. Some have fixed quantity as opposed to stocks that can always issue new shares etc.” (Male in his 50s, US)

“Cryptocurrency seems to be gaining momentum with the fallout of global and national currency systems.” (Female in her 20s, US)

Moreover, in 2020 we saw a wave of institutions coming into the cryptocurrency space, and people in the US noticed. Institutional participation solidified people’s long-term outlook for crypto, and even their perception of it.

Large institutions have started to buy crypto, which could drive up scarcity and therefore the value. That, and after a decade it doesn’t seem like it’s going anywhere anytime soon.”(Male in his 20s, US)

“I chose positive because I definitely think it has leveled out now. In the beginning it was definitely negative (from what I heard). I think it’s a new way of investing.” (Female in her 20s, US)

Why do people have a negative perception about cryptocurrencies?

While the price of Bitcoin has increased over 250% in the last year, many people are still afraid of its extreme price volatility.

Additionally, after seeing many incidents such as hacks and reports from mass media, many are concerned about the crypto’s security risks and usage today. In Japan, where the vast majority of people have negative perceptions about crypto, these security concerns were paramount and deep-rooted into people’s perceptions.

“There was a virtual currency incident in the news a while ago.” (Male in his 40s, Japan)

“There is a possibility of someone stealing it.” (Male in his 30s, Japan)

Lastly, as with any new technology, there is a big learning curve.

“I don’t know enough about it to have a positive opinion.” (Female in her 30s, US)

Many people do not understand cryptocurrencies well enough, which ultimately affects their perception about them. As people learn more about cryptocurrencies, we can expect this to keep changing.

Which investment assets do people think will be most attractive in 2021?

54% of respondents think stocks will be an attractive investment in 2021, making it the most popular asset in the US.

Crypto was two times more popular than Gold and also the 4th most popular asset, as 30% of Americans believe it will be an attractive investment opportunity. In Japan, crypto was the 5th most popular asset, as people favored other investment vehicles such as Mutual Funds and FX.

Diving deeper into the different segments, we saw that for investors in the US with the highest level of experience crypto was the third most popular asset. This group highlighted the high growth that cryptocurrencies have experienced lately and believe it will be one of the most profitable investments.

“ETFs are easy and low cost basis, real estate will always produce profits and bitcoin is gaining steam and will continue growing in 2021.” (Male in his 40s with more than 10 years of investment experience, US)

On the other hand, crypto was the second most popular asset amongst the least experienced investors. Crypto’s run-up in price and increasing adoption spiked the interest of this group, which are looking to capitalize on the latest trends in the market.

Wrapping up

A significant share of Americans are looking to invest this year, as they view investing as one of the most effective ways to increase their wealth. The opposite was true in Japan, where investors have a more conservative stance.

Moreover, the adoption of cryptocurrencies in the US has grown significantly over the last year, as we’ve seen an increasing number of American companies allocating capital into this new asset class and expanding their services to cover cryptocurrencies. The market sentiment is currently very positive, especially when compared to the Japanese market.

The outlook for cryptocurrencies this year looks very promising in the US as it continues growing in popularity, especially with the new generation of investors which favored the asset more than anyone else.

Despite the bearish sentiment in Japan, it remains as one of the most important markets in the world and with one of the most structured regulatory frameworks globally.

Since 2014, our mission as a global company has been to offer the simplest and most secure way to access cryptocurrencies around the world. We plan to continue focusing on offering the highest level of security to our customers and new products to provide more value.

Methodology

Survey period: January 5, 2021-January 11, 2021

Target group: A total of 3,000 consumers (20-59 years old) living in the US and Japanese markets

• Japan n = 2,000, USA n = 1,000

• The data of each market adjusts the composition of gender and age based on the census results so that the trends of consumers in the surveyed countries are correctly reflected.

Survey method: WEB questionnaire survey

* When using the survey results of this release, please specify [Survey by bitFlyer USA.].