Tokyo, Japan – bitFlyer Holdings, Inc. (headquartered in Minato-ku, Tokyo; Representative Director & CEO: Yuzo Kano; the “Company”) today announces that it has entered into an agreement to acquire 100% of the share capital of FTX Japan K.K. (“FTX Japan”) from FTX Japan Holdings K.K. (“FTX Japan Holdings”) (the “Acquisition”).

Transaction Overview

Through a share transfer, the Company has agreed to acquire from FTX Japan Holdings, the shares of its subsidiary, FTX Japan. As described below, FTX Japan is also subject to the United States Bankruptcy Court for the District of Delaware(the “U.S. Bankruptcy Court”)process and the transaction is subject to approval by the U.S. Bankruptcy Court.

Please see below under “Bankruptcy Court Approval Required” for details. The business policy of FTX Japan after the acquisition of shares by the Company is described later in this notice under “Business Policy Post Acquisition”.

| Method of Stock Transfer | Transfer of All Shares Outstanding of FTX Japan |

| Before and After Transfer | Before: FTX Japan Holdings 100% After: bitFlyer Holdings 100% |

| Stock Transfer Agreement Date | June 19, 2024 |

| Stock Transfer Closing Date | TBD |

Bankruptcy Court Approval Required

On November 11, 2022 (the “Petition Date”), FTX Trading Ltd. and certain of its affiliated debtors, including FTX Japan and FTX Japan Holdings (collectively, the “Debtors”), each filed a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code. Therefore, the Acquisition is subject to approval of the bankruptcy court, and the Debtors have filed a related motion to seek authority to enter into the agreement and complete the Acquisition, which is currently expected to be heard at the Debtors’ hearing scheduled for July 17, 2024. The Chapter 11 case of FTX Japan would be dismissed effective as of closing of the Acquisition. The motion and other documents related to the Debtors’ bankruptcy court proceedings are available at https://cases.ra.kroll.com/FTX/

About FTX Japan[*1]

FTX Japan is a wholly-owned subsidiary of FTX Japan Holdings. FTX Japan Holdings was acquired by FTX Trading in April 2022. Prior to the Petition Date, FTX Japan operated a registered crypto asset exchange providing residents of Japan the ability to trade crypto and crypto derivatives. FTX Japan is subject to the regulatory supervision of the Financial Services Agency of Japan (the “JFSA”) and the Kanto Local Finance Bureau, and is registered as a Crypto-Asset Exchange Service Provider and Type I Financial Instrument Business Operator. FTX Japan has not engaged in any operations since the Petition Date. Since early 2023, all customers of FTX Japan have been able to withdraw all of their segregated crypto and fiat assets. The information and documents related to FTX Japan are available at https://www.liquid.com/ja/company/.

[*1]The description regarding FTX Japan is based on publicly available information.

About bitFlyer Group

The Company holds bitFlyer Inc. and bitFlyer Blockchain Inc. as domestic subsidiaries, and bitFlyer Europe S.A. and bitFlyer USA, Inc. as overseas subsidiaries. The bitFlyer Group is committed to “Simplify the world with blockchain”, a mission it has been pursuing since its foundation. We aim to make the lives of people around the world more convenient by solving social issues through technology. Recently, we have been focusing on business expansion in the web3 domain, including the crypto asset exchange business, with the aim of becoming “Asia’s No. 1 web3 company”.

In Japan, bitFlyer Inc. is registered as a crypto asset exchange service provider and Type 1 financial instruments business and provides services such as “Buy / Sell,” “Simple Exchange,” “Lightning Spot,” and “bitFlyer Crypto CFD.” bitFlyer, Inc. has maintained a high level of security with “zero damage from hacking since its establishment” and has become the largest crypto asset exchange service provider in Japan[*2] with assets under custody exceeding 900 billion yen as of March 2024. In addition, bitFlyer Blockchain, Inc. has developed its own blockchain “Miyabi”. The architecture of “Miyabi” is suitable for financial transactions, and its robust security makes it the underlying system for certain crypto assets.

The Company has agreed to the Acquisition because it believes that through the Acquisition, it will be able to develop new services taking advantage of the intergroup synergies under the bitFlyer Group, leading to sustainable and further growth, and therefore the Acquisition is in the best interests of not only the FTX Japan business and FTX Japan customers, but also the bitFlyer Group’s stakeholders.

[*2] As of December 31, 2023, based on company websites, JVCEA and other publicly available data.

Business Policy Post Acquisition

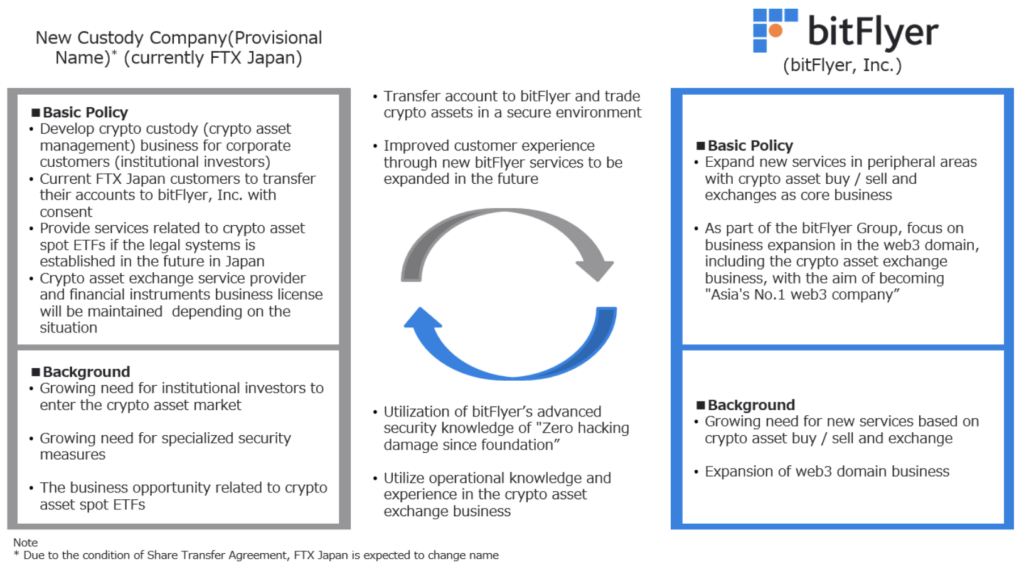

The Company currently expects to pursue the following business policy after the completion of the Acquisition. This business policy is subject to change at any time.

First, under the terms of the Acquisition, FTX Japan will need to change its corporate name as soon as practicable. The new company name is yet to be determined. For this notice we will use “New Custody Company” as its provisional name. The basic policies of the New Custody Company are expected to be as follows:

- New Custody Company will transfer FTX Japan customer accounts to bitFlyer, Inc. with the consent of the relevant customers.

- New Custody Company will offer new crypto custody (crypto asset management) services as its core business.

- New Custody Company will provide services related to crypto asset spot ETFs[*3], centered around its core business, if the legal system is established in the future in Japan.

- New Custody Company will continuously maintain the crypto asset exchange service provider and Type 1 financial instruments business license depending on the situation.

bitFlyer Inc. has been developing its core business of crypto asset sales and exchanges. We believe that customers of New Custody Company will be able to safely enjoy crypto asset trading in a secure environment of bitFlyer, Inc. We also believe that bitFlyer, Inc. will be able to provide further value by expanding its new services related to crypto asset trading.

On the other hand, the new company is expected to develop the custody business as its new core business. The basic policy of the crypto custody business is based on the growing needs of institutional investors for entry into the crypto asset market and the need for professional security measures.

In January 2024, the SEC conducted a re-examination of the previously disapproved Bitcoin spot ETFs and collectively approved rule amendments for the listing of 11 ETFs. Although the situation is not necessarily the same in the U.S. and Japan, this trend is expected to increase the need for institutional investors to enter the crypto asset market in Japan, and crypto asset custody services are expected to become more important.

An important element in custody services is advanced security measures. In the crypto asset exchange industry, a fraudulent leak of crypto assets worth approximately 58 billion yen occurred in 2018. In response to this issue, awareness of security was raised within the crypto asset exchange industry and various measures were taken. However, recently there was a fraudulent leak of crypto assets at the similar level as in 2018.

We believe that in-depth knowledge of the blockchain and technical capabilities are essential for security measures in the crypto asset exchange industry. bitFlyer Group has deep knowledge and technical capability in respect of the blockchain, and has been developing secure wallets at bitFlyer, Inc. Crypto custody service with advanced security measures will be delivered to corporate customers (institutional investors) under New Custody Company, utilizing our knowledge and experience.

While we will need to wait for the establishment of the legal system, including tax regulations, if crypto asset spot ETFs are approved in Japan, services related to crypto asset spot ETFs that meet the needs of financial institutions, including trust banks, will also be offered under New Custody Company.

We believe that the bitFlyer Group will be able to deliver unique value by offering both crypto custody service and services related to crypto asset spot ETFs under New Custody Company.

[*3] ETF (Exchange Traded Funds) are investment trusts listed on stock exchanges. An investment trust is a product where funds collected from investors are invested and managed by experts in stocks, bonds, and other securities. A crypto asset spot ETF refers to an exchange-traded investment trust that includes actual crypto asset as investment targets.

Important Information

This press release contains information that constitutes forward-looking statements. Such forward looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ from those in the forward-looking statements as a result of various factors. Please note that the future schedule has not been finalized at this time.

| For inquiries regarding this matter, please contact Public Relations, bitFlyer Holdings, Inc. Midtown Tower, 9-7-1 Akasaka, Minato-ku, Tokyo 107-6233, Japan Service website: https://bitflyer.com Contact: https://bitflyer.com/ja-jp/contact |